|

|

|

22:43 |

|

|

transcript

|

5:15 |

Hello and welcome to Python for Entrepreneurs.

We are so excited and honored that you are taking our course.

We can't wait to help you build your online business.

Now, before we get to all the mechanics of what we are going to cover, what you need for the course, how to connect to this database or that, let's just talk briefly about why right now is the best time to start an online business.

It's easy to get nostalgic and look back and say well, twenty years ago things were so much easier, I just started like look at the companies that exist now.

But I am going to show you that yesterday was not as golden as we think it is.

It's also easy to say well, I've just got to wait, now is not really the right time to get started, and if I just put it off for another two years all these thing will fall into place and I'll be ready to roll- I don't think so.

I think the right time to start is now.

You build a base, even if you just started as a side business and let it grow, let it mature and build it up over time and you are going to have something amazing.

What did it take to build a business before the internet, an actual physical business, with things made of atoms, rather than bits?

Well, you would probably run full page ads in expensive magazines like this, here is an ad from 1968 when Chevy was advertising their brand new cars.

Whether you were starting a car business or something on main street, it is hard to get started on these types of business.

The startup costs were probably millions, the time to get started is maybe a year if you are fast, it's really hard to get started, the barrier to entry is quite high; and the even so, the profit margin this companies make is quite low.

So General Motors just had a record breaking year for profit margins, and it put them way up in the stratosphere at 6%, that is not very high but there are many businesses like gas stations and stuff that make like .3, .2% profit margin.

It's extremely hard to work with that little bit of extra revenue, so maybe these physical businesses were not the way to go, maybe it was the .com boom days, back in the late 1990s, early 2000s that we should have started our business.

I think venture capital was more accessible at least you didn't have to prove so much to get it, if you'd create a web site with a crazy idea maybe the people gave you money, but to actually get started for most folks was really hard.

I recall in 1998 going to a workshop type thing, put together by a couple of software and hardware companies working together and their goal was to show us how easy it was to build an e-commerce site in 1998, and they said look, all you are going to need is this load balancer, this SSL accelerator, these kinds of connections in your data center, this special hard drive, and they said, in the end, it's just going to take you only a 100 000 dollars to get started.

I think we could have thrown away some of their software and get started from maybe 50 000, but still, that is a pretty high barrier to entry.

This isn't something you just spend up on the side because you have a great idea, it also takes a while to get all those things in place, set up the load balancer, set up the server, set up the software on them, but not just that- connecting the things like credit card systems used to be way harder.

While starting a business in a .com day was easier than before, it's not maybe as easy as we might remember.

what does it take to start an online digital business today?

Let's look inside my business.

The one that you've probably bought this class from.

So I started Talk Python Training in the early part of 2016, and I went back and I did some math to figure how much I spent in time and money to get things started.

It cost me 346 dollars in materials, in hosting, and domains and SSL certificates, to get started, that's it.

I built the entire website with the e-commerce capabilities, the email account management, video delivery, everything in 2 to 3 weeks, that's it.

After that, I launched the first product on Kickstarter and within 2 months was making solid money.

That is a very, very different picture than even the .com days.

And yet factoring this out over time, my profit margins are running at 93%.

I am telling you, right now is a golden time to get started, and throughout this course, I am going to give you a look inside of my business, Talk Python Training and the podcast, and Matt Makai is going to give you a look inside the Full Stack Python.

So you are going to have two real world examples of how we have started a business that to some degree or other is standing out and succeeding.

Now it's not all rainbows and unicorns, there are more challenges in other areas today.

Almost because it's easier to get started you'll see the competition is tough, so let's just go back ten years if you could pass the technical barriers, put money up front to get started, and get things up and running, chances are you would be running in a pretty thin pack, competition existed but it wasn't so tough, it wasn't so hard to get the word out.

However, zoom forward ten years to today, and it looks more like this- even if you are building a business that is unique, it's still really hard to get the word out, so the technical chops to build the business is not enough.

That's why in this course we are also going to talk about SEO, growth hacking, the things you need to stand out and break free of this dusty pack.

All right, competition now withstanding, I hope you are excited to get started because it is a golden time to start a business, and we are both super excited to share our story and our techniques with you.

|

|

|

transcript

|

2:16 |

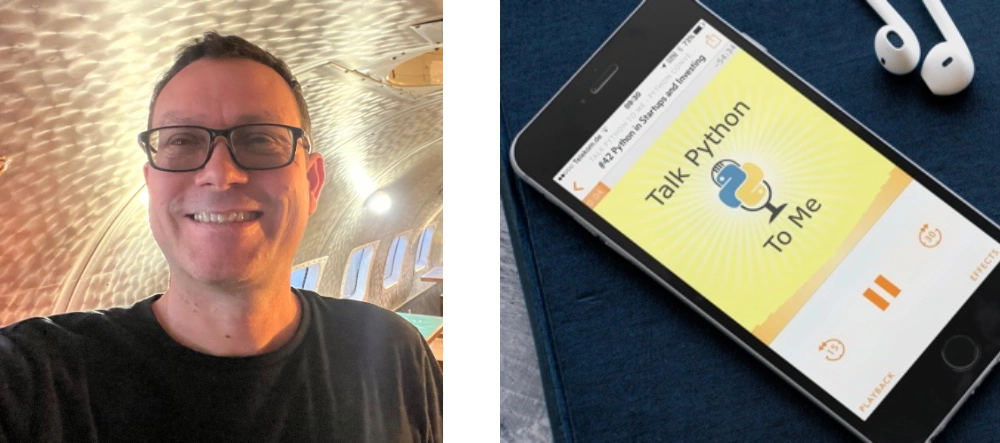

It's time to meet your instructors.

This course is co-written and co-recorded by Michael Kennedy, that's me, from Talk Python and Matthew Makai, from Full Stack Python.

We'll each be presenting various sections of this course, and looking inside our individual businesses, and that's why we wanted to take this moment, show you our picture, let you get used to our voice so you'll know who's presenting when.

Let me tell you a little bit about myself.

I'm Michael, hey nice to meet you, I'm really excited that you are taking my class.

I created Talk Python To Me, the number one Python podcast which, within almost year and a half has had over 2 million downloads.

That, in and of itself is a really interesting business story to cover and a large portion of my income actually comes from running the podcast day to day.

When it makes sense, we'll look inside the software or the techniques I've used to start that podcast and make it successful.

Of course, you are taking this course through Talk Python Training, and I started that as well and in the opening section I gave you a bit of an introduction there, but this part of my company was created in just a couple of weeks, and then the first course was created about a month after that, and many of the ideas and techniques in this part of my company the e-commerce, the mailing list, those sorts of things are definitely going to be covered in depth and you'll be looking inside of that software, seeing the source code I wrote to run my actual business, not just a bunch of demoware.

Welcome to the course, I'm super excited to be sharing with you, it's a course I wanted to create for a long time, and I am honored to be creating with Matt Makai, from Full Stack Python.

Thanks Michael.

Hey folks, my name is Matt Makai, and I am the creator of Full Stack Python.

And I am also a developer evangelist with Twilio.

I started Full Stack Python back in 2012, because I had a bunch of junior developers on my team and I wanted to explain to them how to build and deploy web applications.

It just expanded out from there.

In 2014, I joined Twilio as a developer evangelist.

I started out in Washington DC and now I am out here in San Francisco in the Bay area.

Twilio makes it easy for developers to add communications, such as phone calling, messaging and video, into their web and mobile applications.

The best part about this job is I get to help developers build and deploy their applications, just as I am going to explain some of the technical concepts throughout this course that will help you build and deploy your own business.

|

|

|

transcript

|

4:26 |

We can group these general topics we are going to cover into five big areas.

First one is building your online product.

This is web development and web design.

So we are going to talk about how to actually build your web app and how to make it look good.

We are also going to talk about managing your development process, with your editors, source control, that kind of stuff.

Then we are going to take your online product and show you how to turn it into a functioning business.

How do we integrate credit cards, how do we integrate email, all the various things that you need to actually have a working online business.

Then we are going to talk about putting that business online, how do we deploy it, how do we setup our servers, and virtual machines, how do we monitor for errors in performance and production.

And finally we are going to talk about growth.

Remember the opening section, that dusty set of motocross riders?

we are going to talk about how you can break free of that pack and get ahead.

So if we look at the technologies that we are going to use to build our web app, it's going to start with our web framework, Pyramid.

There are many web frameworks we can choose in Python, the three most popular probably are Django, Flask and Pyramid, and Pyramid is a really nice balance between too much hand holding and too small, it's the goldielocks framework, in my opinion.

We are also going to talk about Python some of the core language concepts that you need for your web app to work and we are going to use SQLAlchemy to talk to our database and create a data-driven web application.

So, this is the code side; on the other hand, we also need it to look decent.

Now, we don't assume that you are a designer, but we are going to show you enough CSS and HTML that you can build something that is functional and - not terrible - let's say, and if you're great at design you could probably do way better than that, but we'll get you started so that you are at least comfortable with HTML and CSS and some of the front-end frameworks, we are going to use Bootstrap but there are a couple of options there.

So, these are the technologies involved in building your web application.

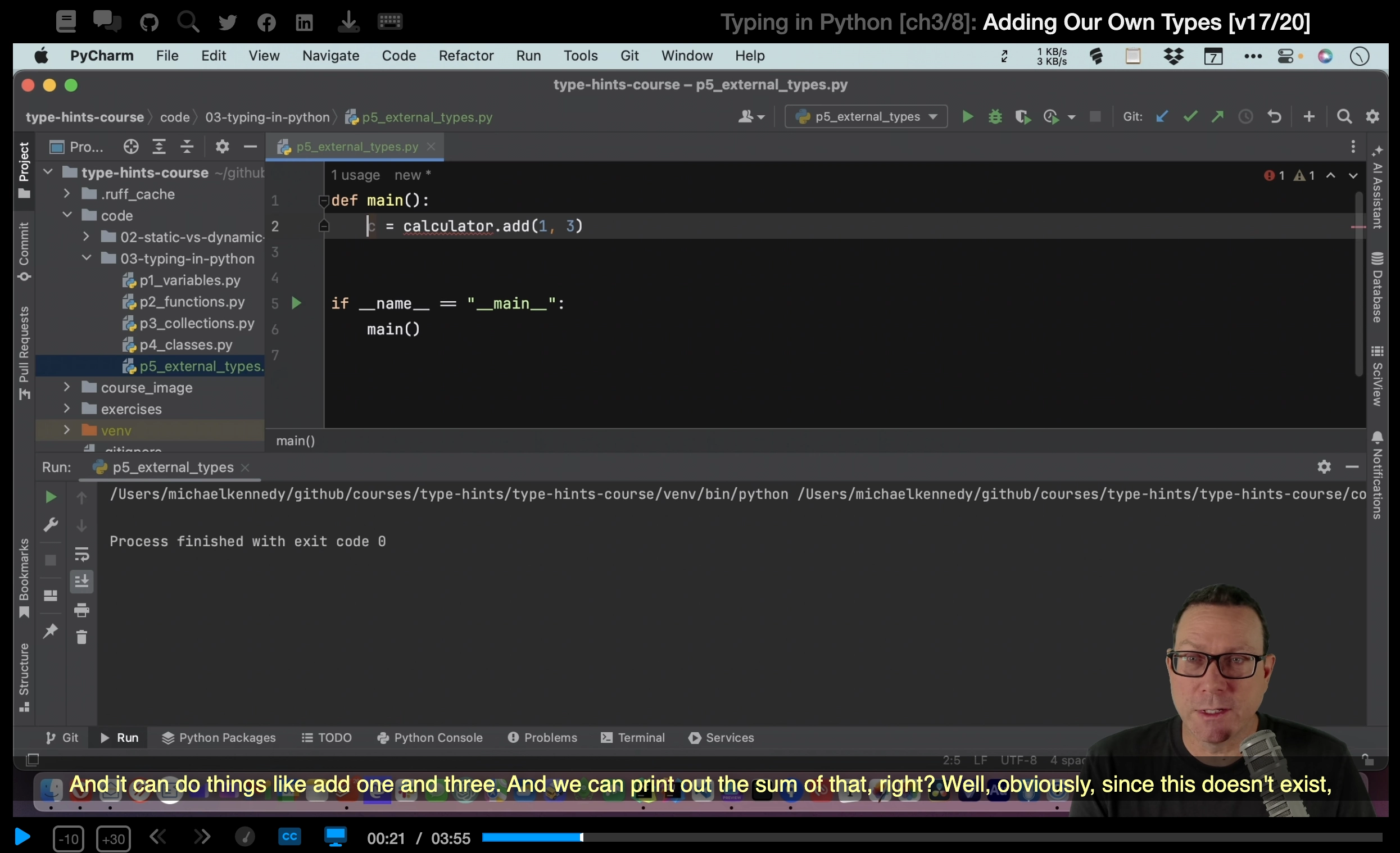

And while you are building it, we are going to talk about what you need for the development process.

We are going to be using PyCharm as our IDE, our enhanced editor that will let us do all kinds of things, we can create a Pyramid web app with it, we can of course edit the Python code access and manage our database, work with JavaScript and CSS and HTML, it's a great all-around editor for what we are trying to do.

We are going to use Git and GitHub to manage our code, make sure that it's safe and sound, we can always get back to a previous working version and most importantly, it will let us aggressively experiment and try new ideas without fear of breaking it irreparably.

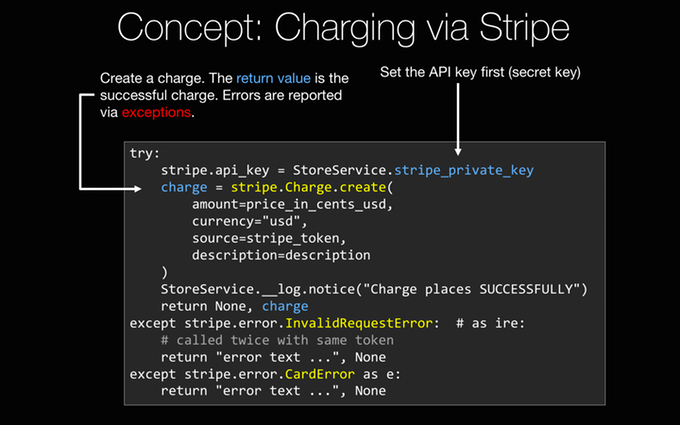

Once we have our application built, we are going to have to make it a real business, so we'll have to deal with users, users' accounts, all the various things around resetting their passwords and sending them receipts, that kind of stuff, so we'll have to have inbound and outbound email, and most importantly, to us, probably is accepting money from them, so we are going to integrate Stripe and credit card processing into our application.

Once our app is ready to go live, we need to put it on web server somewhere.

So we are going to deploy it onto Ubuntu, using Digital Ocean, so we want to create some virtual machines on Digital Ocean that are Ubuntu servers and we'll push them out.

Of course, for accepting credit cards and working with user accounts and passwords, we are going to want to use SSL so we'll see how to integrate SSL into our web server, we'll use nginx as the front line web server and then we are going to use uWSGI, to run our application behind the scenes.

Once we get it all up and running, we want to make sure that it's working right, so we are going to integrate Rollbar error monitoring into the system, that will send us messages on Slack or email or whatever we want if something happens to go wrong, and we may know if there is a problem before even our users do.

Finally, we are going to talk about growth, because, having the technical pieces in place, as we said, is not enough.

These days, running a business is as much about marketing and positioning as it is about the technology, technology is of course required and table stakes, but to really break free you have to work on getting the word out, standing out on Google, reaching the users where they are.

So, we are going to talk about SEO in Google, we'll talk about mailing lists, acquiring interested users, converting them to paying users, and a whole bunch of other things that fall into this banner called growth hacking, a bunch of techniques that are non-obvious and maybe users never see but actually attract attention, attract users, and grow your business.

|

|

|

transcript

|

3:26 |

Here is a quick section to let you know that it's OK to skip around.

We didn't build this course for you to take it in a straight line, part one, part two, part three and so on, we built it to maximize the efficiency of you building and launching your online business.

If that means there is sections you already know, and you want to skip over them, that's fine.

If there is something that's extra important and you want to start there, you want to skip right to that, like for example integrating credit cards into your system or error monitoring or deployment, it's fine, our goal is to maximize your productivity, to minimize the time that it takes for you to get started.

So, maybe one path through the course starts like this: you watch this introduction, including this video here, you already know Python, so maybe skip that, you don't know Pyramid, so make sure to do the Pyramid parts but you have web design and CSS and Bootstrap, you know those things, skip that, but maybe come back, learn some SQLAlchemy, jump over the credit card section, and so on.

That's how the course was built, we want these pieces to be somewhat independent, even though the application builds up over time, and we want to encourage you to get the most out of it and not sit through an hour of something that you already totally know, like for example CSS, if you know CSS.

We are also going to be giving you additional resources so if you go through a section and you are like "oh I really wish we went deeper into something" - both, the Talk Python To Me podcast and Matt's Full Stack Python have incredible amounts of additional resources, for example, when we talk about Pyramid or SQLAlchemy, we spend about an hour with each of the founders interviewing them about their project where it came from, where it's going, so we'll make it to those areas, maybe I'll point you at those interviews for example.

And Matt has a whole book on deployment and a ton on web servers and the DevOps side of things, so he's got a ton of how-to articles and links that he'll be sharing throughout this course.

So, on one hand, skip around, jump over things you don't need, and if we don't go deep enough, we'll try to give you extra resources that you can find, mostly from our resources that we build ourselves, but also additional third party ones, if that makes sense.

|

|

|

transcript

|

1:24 |

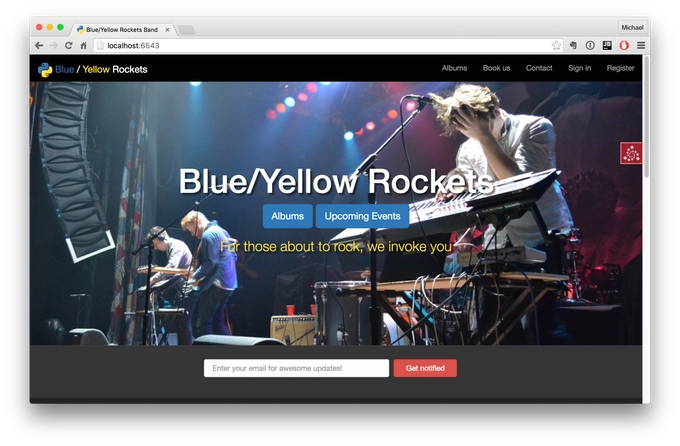

So you are ready to build your own business, we are going to build one together, and what are we going to build?

Well, we are going to build a rock and roll band's e-commerce site.

And this is our favorite fictional tech-based rock and roll band called The Blue/Yellow Rockets.

And, you can see right on the screen we've got a nice design, with the CSS front-end framework, this is Bootstrap, it's responsive, we also have mailing lists for users who are interested in hearing more about our events that are not yet published, under the albums, if you went in there you would see that you could do e-commerce, sign in and register lets us create accounts, most of the things that you can do in our app, you can see right on this front page here, so we are going to build this app slowly; first we are going to start out just building a basic website that is static.

And then, we are going to add a little dynamicness to it, using SQLAlchemy and databases, then we are going to add credit cards and mailing lists and all the stuff you need to do to build a business rather than just an app, and then we are going to deploy that and use a little SEO to try to get it to show up in Google.

So that's what we are going to build, and of course, you want to have the source code, so how do you get it?

Well, GitHub of course, here at this URL, you will be able to go and download everything you see us create throughout this class, so I recommend you go right now to github.com/mikeckennedy/Python-for-entrepreneurs-course-demos.

Maybe that's a little bit long, but go there and either star this or fork it or both.

|

|

|

transcript

|

3:51 |

So why do we have sponsors for this course that you paid for?00:05 Well, here's the deal- I knew that there is a bunch of companies making cool tools 00:10 like Jetbrains makes PyCharm which we're going to use in the class anyway, 00:13 and we've got Digital Ocean they have great hosting, 00:16 and I'm going to use them in the class anyway.00:19 So I thought hey look if I reach out to these guys 00:22 maybe I can get some special deals for you, 00:24 in fact that's exactly what I have in store, so hang in there.00:27 So how did I pick these sponsors?00:30 Well, actually I came up with a course outline 00:32 and I knew that I would be talking about PyCharm because I love PyCharm 00:35 regardless of whether or not they sponsor this,00:37 I knew I'd be talking about Digital Ocean, 00:39 I have all my servers running there and I've had great success;00:41 I knew I'd be talking about Rollbar, things like this.00:44 So I simply reached out to the companies I was going to feature anyway00:47 and said hey would you like to be part of this course 00:50 and give the students some things?00:52 They said, many of them said yeah that's awesome, 00:54 it looks like really cool what you're building, we'd love to work with you on this.00:57 So that's how we came up with them and because of that,00:59 this didn't really changed the content, it's not like we now have 01:02 a section on Rollbar because Rollbar sponsored the show,01:04 quite the reverse, we're going to have a section on Rollbar 01:07 and Rollbar decided to sponsor the show to be very supportive as part of that.01:11 So let me tell you quickly about the sponsors, and the things that they have to offer 01:15 and then we'll come back to each one of them later in the course.01:18 So, first of all Rollbar.

Rollbar is super super important 01:24 if you're going to run your code in production 01:26 and you are going to do it as a small team 01:29 you won't have people constantly monitoring the servers, that's probably you; 01:32 and so with Rollbar, you can just basically add a few lines of code 01:35 to your pyramid web app or whatever type of web app you build 01:38 and anytime there is an error it will automatically capture all the details 01:42 and send those back, store them on Rollbar and send your notifications 01:46 like Slack or HipChat to your phone and so on.01:49 In fact, just about an hour ago, I pushed out a bad update to the site,01:53 something went wrong, I forgot to check something01:56 for when users were not logged in versus when they were logged in 01:59 and my phone started blowing up, 02:01 so instead of letting it just be broken for an hour or half an hour 02:05 whenever I go back and check my e mail and people say 02:08 hey Michael the site's broke what happened;02:10 oh yeah, yeah, I must have broken something.02:12 I immediately got a notification and fixed it, 02:14 so yeah I broke the site but Rollbar, they got my back.02:18 We will talk about integrating Rollbar in chapter 17,02:21 which is called logging and monitoring.02:24 So there we'll get into detail with Rollbar, they have a great free plan,02:28 so you can use basically use their services for free.02:32 PyCharm, we are going to use PyCharm throughout this course 02:35 that's the editor that I really like and you don't have to use PyCharm02:40 to do this course, but I very much like it, 02:42 and I think you're going to see as we go through the course 02:45 it has so much to offer that is really really worth using.02:48 They have a free community edition and that's cool, 02:51 the one drawback of that is it doesn't do web development stuff 02:54 so the PyCharm guys over at Jetbrains decided to offer all the students 02:58 a free three month pro license, so check your user account or a course page,03:03 I haven't quite integrated this yet, but either in your user account or on the course page03:06 you should see the ability to claim your PyCharm license.03:11 Digital Ocean is where I have all of my servers,03:14 they offer very high performance ssd backed virtual Linux servers,03:18 they are super fast, no nonsense, easy to set up, 03:22 and I just love them, we will be talking about them 03:25 when we get to the deployment section.03:28 Again, like PyCharm, these guys wanted to offer you something special 03:31 so they're giving every student a $50 credit 03:34 to do whatever you want at Digitial Ocean, you can get servers for five bucks03:37 so that could be like ten months of hosting; 03:39 or if you want to go crazy, get a slightly bigger ten dollar a month version 03:42 and you have still five months of free hosting,03:44 that's great, so check out Digital Ocean, we'll be talking 03:47 about Digital Ocean in the deployment chapter which is chapter 15.

|

|

|

transcript

|

2:05 |

Welcome to your course i want to take just a quick moment to take you on a tour, the video player in all of its features so that you get the most out of this entire course and all the courses you take with us so you'll start your course page of course, and you can see that it graze out and collapses the work they've already done so let's, go to the next video here opens up this separate player and you could see it a standard video player stuff you can pause for play you can actually skip back a few seconds or skip forward a few more you can jump to the next or previous lecture things like that shows you which chapter in which lecture topic you're learning right now and as other cool stuff like take me to the course page, show me the full transcript dialogue for this lecture take me to get home repo where the source code for this course lives and even do full text search and when we have transcripts that's searching every spoken word in the entire video not just titles and description that things like that also some social media stuff up there as well.

For those of you who have a hard time hearing or don't speak english is your first language we have subtitles from the transcripts, so if you turn on subtitles right here, you'll be able to follow along as this words are spoken on the screen.

I know that could be a big help to some of you just cause this is a web app doesn't mean you can't use your keyboard.

You want a pause and play?

Use your space bar to top of that, you want to skip ahead or backwards left arrow, right?

Our next lecture shift left shift, right went to toggle subtitles just hit s and if you wonder what all the hockey star and click this little thing right here, it'll bring up a dialogue with all the hockey options.

Finally, you may be watching this on a tablet or even a phone, hopefully a big phone, but you might be watching this in some sort of touch screen device.

If that's true, you're probably holding with your thumb, so you click right here.

Seek back ten seconds right there to seek ahead thirty and, of course, click in the middle to toggle play or pause now on ios because the way i was works, they don't let you auto start playing videos, so you may have to click right in the middle here.

Start each lecture on iowa's that's a player now go enjoy that core.

|

|

|

|

12:41 |

|

|

transcript

|

1:41 |

The first thing that you are going to need to take this course is Python.

We are going to be using Python 3 in this course.

You may or may not know there is bit of a divide between an older version of Python called Python 2, sometimes referred to as legacy Python, and a newer version of Python 3.

But, the tide is basically turning and Python 3 is really the best choice to start new projects today.

We are not going to go into too much detail about the differences, we are just going to focus on Python 3 in this course.

You can download Python 3 from here if you don't have it or if you are on Linux you can use things like aptitude to get it, we are going to actually go into detail how to setup all of these tools on your machines, but just know Python 3 is one thing that's going to be required.

The other is a great editor, and by far in my opinion the best all around editor for building web applications in Python is PyCharm.

So we are going to talk about how you download and install PyCharm, there is multiple versions, editions I guess you would call them, and we'll talk about which one you are going to need and why to choose that and so on.

There are other choices if you don't want to use PyCharm, you don't absolutely have to, you can work without it of course, and we'll talk a little bit about that in the upcoming setup videos, but let me just leave you at the one thing - why would you use PyCharm?

You are going to see throughout this class why this is absolutely the case, but we are not there yet, it's going to take a while to build up all the various moving parts, they are like OK, this thing really is awesome, so while ago, back in 2015 I wrote a blog post called Nine Reasons You Should Be Using PyCharm and you are welcome to check that out if you want to see just some of the benefits.

|

|

|

transcript

|

3:11 |

Hello my fellow OSX fans.

Let's talk about getting your machine setup so you are ready to take this course.

The first thing you are going to need to do is set up Python 3.

We can check to see whether Python 3 is installed, first let's see what happens when we say Python--version.

OK, so we have Python 2.7 installed, that comes with the OS X, that's cool.

But if we ask for Python 3, which on OSX we can do by typing Python3 like this, you'll see no, there is no Python 3.

So, just download it and choose that, choose the 3.5.2 choose whatever the current version is when you get here.

Now, I already downloaded it so let's go and install it.

It just comes as a package, install package, so just next your way through it.

Excellent, it looks like it was installed just fine.

Now, let's try that again.

Excellent, we have Python 3.5.2 installed.

So Python is all set up, the other thing we are going to need is an editor.

And we already talked about using PyCharm as the editor for this course.

So, over here at jetbrains.com/pycharm we'll see, here is the PyCharm page, and we can go and just download that, there's actually a choice when you go to download, do you want the professional or do you want the community edition.

Now, what's the difference?

Well, on the other page, if you scroll down farther, you'll see that for the basic Python stuff, everything is the same, right, the community and the pro edition.

Where they really differ, unfortunately for this class, is actually where it matters.

So, in addition to having the regular Python support, it's all about web development, the web frameworks, database support, things like that are only available in the pro edition, but luckily there is a 30 day free trial.

And it's not too expensive, you can pay $8.90 a month or you can pay $89 a year and it gets cheaper as it goes on and on.

So like I said, I've already downloaded PyCharm, let's go ahead and mount it, it's a disc image, and installing is pretty much draggy droppy, no problem, just wait for it to copy over.

And now it's all ready to go.

When it launches, it will ask you the first time what theme you want and so on, I would choose, I like the dark theme so I choose the Dracula theme for both the IDE theme and the layout or font colors.

You can pick whichever you want.

And there you go, PyCharm is ready to create a new project, of course, we are saving that for a little bit later, but just to look ahead, it's going to start right there.

If for some reason you really don't want to use PyCharm, Sublime Text is a great option, it has support for Python, JavaScript, CSS, not as good as PyCharm but still, not bad.

Another good recommendation is Atom, if you want the more lightweight text editor, so you can download that, and it's also free, this is from GitHub.

But like I said, we are going to be using PyCharm for most of the course, and it really is more full-featured, more helpful, more efficient than most of these.

All right, this Mac is ready to rock and roll and get going on this course.

|

|

|

transcript

|

3:59 |

If you are using Windows, let's get it ready to build your business with Python.

So the first question you might want to ask is: "Do I have Python on my Windows machine?" And there is a very high probability the answer is no.

But let's just verify.

So we can start by just typing "Python" and see what happens.

Nothing, there is no Python.

By default Windows does not include any form of Python, which is unfortunate, but that's the case.

The first thing we have to do is download Python.

And over here at Python.org we can choose the version 3, so Python 3 whatever the latest one of that is, so I've actually already downloaded it, that's over here, so we can go ahead and install that, it's super easy, just run the installer, I would certainly advise you to add Python 3 to the PATH and you probably want to customize this, we don't really need it for all the users, but that's good.

What else do we want?

Why don't we go and precompile the library that might make it a little faster, associate the Python files if we want and you'll notice that it's going to go into your user profile here under the hidden AppData\Local folder, so I prefer to have it a little more discoverable for me, so I am going to say "this is going to be Python and it's going to come here." So I can just come to my user profile and find it.

All right, let's go.

Great, Python was installed, now let's see if we have it up here.

We still don't have it and that might seem a little bizzare, we added it to the PATH, we've installed it, but these prompts read the PATH from the system when they launch and they don't auto refresh.

So let's try again.

This time I'll just ask for the version.

Python 3.5.2.

Perfect.

So, Python is ready to roll on this machine.

The next thing we need to do is set up our editor.

We are going to use PyCharm.

We talked a little bit about why we are choosing it in the beginning, but let's just go over here you can see if you hit download, and this is at jetbrains.com/pycharm, there is actually two options here, we can use the community version or the professional version, if you go back to the original page, you'll see there is a "choose your edition" section and it will show you what the differences are.

And so, the main Python features - version control, auto complete, things like that are identical between the editors, but, for this course you are going to need some of the pro features - web development, Python web frameworks like Pyramid, as well as the database support.

So you want to make sure you get the pro edition, it comes with the 30 day free trial and if you want to buy it, as an individual, you can either get it for $89 a year or $8.90 for a month.

So, you could get just a month worth to try out this class, if you are going to take more than 30 days to get it finished, I really recommend that you use PyCharm, the pro version, you'll see throughout the class why it's so much more powerful than many of the other options.

That said, if you don't want to use PyCharm, you don't have to, you could use something like Sublime Text, this is a great editor, so you can get that at sublimetext.com or Atom, at atom.io from GitHub, also a good, more lightweight editor.

So, I already downloaded PyCharm because it's little big, and let's just run that, there is really not to much to do here just got to decide how you want to either put it on your desktop or associate with "py" files, things like that, and let it go.

And, let's go and run it.

When you first launch it, it will pop up this window and ask you what hot keys you want and what theme, if you are on Windows, you probably want the Visual Studio hot keys and if you want it dark, a dark editor like mine, that's how I like my code, then choose the Dracula theme, otherwise you could probably just pick the default.

All right, now we have Python and we have PyCharm, this Windows 10 machine is ready to build a Python-based business.

|

|

|

transcript

|

3:50 |

If you are using Linux, it's time to get your machines setup to take this course.

Let's see what's involved.

Here we are in Ubuntu, and you can see I have the PyCharm page pulled up, so there is a couple of things we need to take this course, we need Python 3, and we need PyCharm.

As we get it farther into the course, you'll see that there is some packages we need, we are also going to need Git, but let's save installing that until later, this is what you need to get started.

So, the first thing is to ask well, "do you have Python 3?" Let's find out.

If you just type python --version, you'll see that that's Python 2.

That's cool, in Ubuntu, you can type "Python3" to run specifically Python 3 regardless of how your path is set up, and let's see what do we get here.

3.5.2, that is the latest.

So, it looks like we already have Python set up, that's great, and if you have 3.5.1 or 3.4 something, that's fine, as long as it's basically a new version of 3.5, we'll be in good shape.

The other thing that we need to get is PyCharm so over here at jetbrains.com/pycharm I've got the page pulled up and you can see it says "download now", and if we go to download it, there's actually two editions, the professional edition and the community edition.

Well, which one should you pick, what's the difference?

If you go back to that first page, you can scroll down a little bit and see there is a little comparison table here, all the Python features about code inspections and auto complete, things like that are exactly the same between the two editions, for this class though, we are going to need a few extra things that are not covered in the community edition, because we are doing web development and we are working with databases, you will definitely want to use those features in addition to the Python web frameworks like Pyramid.

So, I strongly recommend you get the professional version, there is a 30 day free trial, if you want to buy it it's not too expensive, as an individual you can either pay $89 or if you want you can just pay $8.90 a month for a couple of months, as you go through this course, I think it's totally worth it.

If for some reason you really don't want to use PyCharm, you can get away with that, you can use Sublime text, this is also a highly capable editor, as you'll see, there are quite a few features that PyCharm brings that Sublime text does not.

Especially when you are newer, it will help you even more, bur regardless of your experience level, I think PyCharm is a much better choice, nonetheless, you may want to use Sublime Text or Atom is also a great Python capable editor from GitHub.

So those are your choices for the editors.

Now, we've got Python, we downloaded it, I actually already downloaded it because it's kind of large, so let's go and install this.

Over here, we are going to uncompress it, and we'll just extract it here, so we want to take this folder and put it somewhere more useful, I like to have this little bin folder over here, so we are going to move this over, I mean the name in here is not the best so let's rename it, like the version number rather, so rename this, so we want to run this file, so if I double click it, obviously it's just going to open up the editor, so let's go back to our terminal here, and we can try to run it like so, and it's going to go and launch, perfect.

Now, you may have to install the JDK, because PyCharm is based on IntelliJ, which that platform is a Java based application, so if you try this and you get a Java error, just install the JDK by googling for whichever version it says that it needs and install that, then you should be able to run this.

The other thing is, this is nice that it's over here but when I close it, it goes away.

So we can come over here and say lock that to the launcher, that way when we close it, we don't have to have this thing open, we can just re-launch it from here.

Great, so this Linux box this Ubuntu box is ready to take this course, we have Python 3 installed, by default, and we have PyCharm set up and ready to roll, so let's get to it.

|

|

|

|

18:05 |

|

|

transcript

|

1:39 |

So what you are going to learn in this chapter about Python?

Well, mostly it's really to give you enough Python to be able to follow along.

For example, when we get to the credit cards section, when we integrate Stripe into our web app, we are going to talk about exception handling with "try...except" blocks.

And, if you are not totally familiar with those, that might get a little confusing.

So we are going to give you a really short introduction on exception handling and a bunch of other Python concepts like that.

That said, if you know all these ideas, if you are already a Python programmer, don't feel bad about skipping this chapter, go ahead and skip the whole chapter, go on to the next one, and then you can come back and use this as a reference.

This section will be broken into many small little videos, one core concept each.

So, if you find we are working with some idea and you are like, Oh, I actually don't know this very well, just jump back to this chapter, find that core concept, watch the video and then continue on where you left off.

That said, we are covering a lot of concepts in Python, but this is not an introductory course.

If you really need to learn Python from scratch, and you want to do it in a solid way, I recommend that you take my Python Jumpstart By Building 10 Applications course, which you can find at talkpython.fm/jumpstart.

So we cover about the same number of concepts in that course, as we do in this one, but that one covers it in seven hours, instead of however long - half an hour, an hour, whatever this section turns out to be.

So, this chapter is a bit of a choose your own adventure, if you stay here, we are going to do a demo in the next section and we'll build a little game, to get you comfortable with the Python language and the editors, or skip this chapter and get right on to the next one.

|

|

|

transcript

|

5:28 |

So let's take a few moments and spend some time getting you familiar with Python, maybe you've seen it a little bit but it's been a while or maybe you are fairly new and just seeing it in action will teach you much of what you need to follow along, and of course, we have the detailed reference section in the course if you want to look at any specific topic or concept.

What we are going to build in our demo section is a memory game.

It will show colors to the user and the user will have to recall the colors in the correct order.

It's going to be very simple but at the same time it's actually going to cover a decent amount of what you need to know to get started outside of the web frameworks, which we'll cover separately.

So, here we are in PyCharm, and I've created a new empty project based on Python 3, but that's all I've done.

To get started, we are going to need to create at least one file, let's go and create a couple of files here, one of them is going to be our game and this is going to be the actual objects and data structures in our game.

And the other one is going to be the plain of the game, so we'll call this one "program".

Let's focus on the game first.

Like I said, the game is going to keep a history of colors shown to the user and then we'll go back and ask them "what colors did you see?", and of course hide the colors and say "what colors did you see?", and they have to recall them in the correct order.

So let's create a class called Game, the way we do that is we use the class keyword and say the name and the type if we had any subtypes, we could derive it from here, but we are not going to do that, and we are going to go over here and we are going to define an initializer.

So, a __init__ and PyCharm will write most of that for us.

In here, we need to keep track of a few things, we want to keep track of the history and so on, but let me just write "pass" for just a minute.

What I want to do is I actually want to sketch out how we are going to use this gameplay, and I want to show you how PyCharm makes this incredibly easy to do.

So we are going to have things like "add a move", or "add a color", "show the current configuration" or the level if we are going to call it that, maybe first level, second level, and number of colors they have.

And then we want to test the users, so we want our game have those operations.

I could just go ahead and just say "def" and I want to create a method here, so I create a method by saying "def", let's call it show_level(), and when I hit open parenthesis you'll see that PyCharm add self, which is required as the first parameter for Python classes, and we are not going to really need anything else here.

So, I could do some stuff that we are going to work with here, some variables we want to set, but I want to show you that we can actually sketch out the flow and have PyCharm fill in the details for us.

We are going to come over here and we are going to have a main() method, this is not a Python convention, this is just a Michael convention, and what I want to do is I want to work with our game in other modules, so we'll say "import game" and then we could say "game.game" or perhaps a better way would be "from game import game" like this.

So, that's going to be our game object down here so we'll say "g = Game()" to get started, and we have to think well, how is this going to be played?

We probably want to go around in a loop as long as the person can remember all the steps, we want to do a few things each time through the loop.

So we'll do a "while" loop, we'll say "while True", because we just want to keep going around and around as long as the person has won.

So the first thing we want to do is say "game", we are going to say add move.

Now notice, this method does not exist, and PyCharm is highlighting this saying: "there is a problem here, this doesn't exist." But, we can come over here and hit Alt+Enter and it will actually add that method to class for us.

So we can go over here and say "we are going to add a move" and then we want to say "game.show_level()", that's the next step we want to do, and then, we want to test the user, so we'll do a conditional here, we'll say "if", we want to see whatever we want to do to test them, we'll ask them to enter the colors, maybe all in one line, or one entry per line if we're at level 5, there might be 5 entries they have to put, However we test them, we want to have the game do that test here, we want to check, if they don't get it right, we want to stop the game and say "sorry, you lose"; if they do, then we want to just keep going through loop, so we'll say "if not" - the negative of testing, something like this, we'll say test_user, a player, let's call them player, this is kind of more fun to call them player, so we'll say test_player, if that's not the case, what are we going to do, well, let's tell them they lost, so we can print out the message and we can break out of this loop.

And down here, we will print something like this, "Game over".

So, let's look at this for a moment, we are going to create a game, which comes out of our module here, and while basically forever, until we decide it's time to break out, we are going to add a move, we are going to show the level to the user, and then we are going to take it away and then we'll test the user and if they get it right, we are going to add yet another move, show the level, which is now more complex and so on.

This will not actually run, if I run this program here, it will just basically define this method, so in Python, we have a common convention that lets you say "if you are running this program, instead of just defining the method you can actually run it", and the way we do that is we can use a shortcut and the convention is this __name__ that is in the module whatever module's been run, if it's being imported, the name will be the name of the module like "program" or "game", but if it's being executed as a target, it will be __main__ and we can say "OK, this is the time where we want to call this method we just wrote." I can see that PyCharm says we don't yet have this method, let's go and write that as well and it's going to need to return True or False.

Ok, so we now have this structure for our game, what we need to do is actually go implement the game class over here, what does it mean to show the level, what does it mean to add a move, things like that.

|

|

|

transcript

|

10:17 |

Now when we have the basic shape of our game built, let's go and actually implement it.

So to get started, there is two basic things we need to keep track of.

What are the things we could show a user, like what colors and what have we shown the user.

So we'll come over here and we want to define a variable on this object so we'll say "self." and we'll just create a variable name out of thin air, and that is how you define the variables, make sure this happens in the __init__ method, not somewhere else, so we want to say "history", and we want this just to be an empty list so we can do that with just empty brackets like so.

The other thing we want to keep track of is we want to have the choices, or "plays" let's call them.

This is going to be another list and this is going to contain all the distinct plays that we could have, so we might have red, we might have blue, we might have green, let's say we are going to have four colors, OK.

Now, in order to make this a little nicer game, let's add some color and some more verbiage, but we want to have a short thing to test against, so we don't make the user type red they can hit "r" and "b" and so on.

So instead of putting individual items in here, we are going to put something called tuples, and this will let us put multiple values for each particular play, so we are going to put in here, we are going to say "Red", that's going to be what we show the user but what we are going to test for is just "r" and then yellow and so on.

Ok, this is a good start, we are going to improve this in just a minute, but let's finish some of the other implementation here and then we'll move on.

Next, let's turn our attention to show_level(); I would like to be able to clear the screen, whatever is on there remove it, show them just the colors that we've picked or that we have at our current level maybe four colors at level four, and then take that away again, so we are going to need a "clear" method, so we can say self.clear, like so, and we can add that method here, which goes at the bottom, we are going to use a pretty cheap way to clear the screen here, we are going to go and import one of the system modules, so to use something out of the standard library, we have to import it, so we are going to "import os".

Now we could do a little bit of work to test what platform we are running on, but I am just going to do it from Mac, you do it for whatever you want to run it in for, and you could use the sys module to figure out whether you are on Windows or on a Linux Unix based machine.

But we are going to say "os.system" and call a system command, and a system command we are going to do is clear.

Right, that's what you type in the console or the terminal to clear the screen and that's where we are going to have our game here.

Now PyCharm is giving us a little warning that this doesn't have to be a instance method, it could be a static one, but just to keep things consistent, I am going to say "don't bother us with that".

So you won't see any squiggles there.

Right, so first thing we are going to do when we show the level is we want to say "we want to clear the screen", and then we want to go through each item in the history remember up here we have this list, "history", so we'll say "for h in history" and when you...

in self.history, in Python the primary way to process a collection is to use this "for...in" loop, so "for" some variable we make up in the collection, so if we have ten items in our history, we are going to pull them out and work with them one at a time here, so than we could say "print", now, we need to think about what are we going to put into this history here, and what we are going to put in are basically selections of these, so we want to print out the first element here, so there is a couple of things that we can do but let's just keep things simple we'll print [0] there.

The next thing we want to do is also we don't want to have this pile vertically, let's have this just go horizontally, it seems like that's a little better so we can say the "end" is just going to be two spaces, or a comma or something like that.

If it prints this out as fast as they can and it goes away, that's not going to be so great so what we want to do is we want to make it go slowly so we can put this thread to sleep using the time method here, and we could go to the top up here and type "import time" or in PyCharm hit Alt+Enter and say "we would like to just import this name", so see how I wrote "import time" at the top, and now, it has a handy little sleep function and let's say it's going to sleep for two seconds.

Now, something that happens in this that you won't see until you run it but while I am here I will go and take care of it, I'll put a note that we need to flush the output, just because the way it works in the terminal this doesn't always flush that stream as you sleep, and so it doesn't show in a nice smooth way, we'll see that we need to do that here.

And maybe two is a little long, let's put that at one, and last thing, after we are done showing them that, let's "clear", this is going to take that screen away, so we are going to show them the history, clear the screen, show them all the moves they are suppose to remember and then take it away.

And then we are going to test them, but before we test them, let's add a move, right?

We've got to start out with the empty set of history, let's add some will say self.history to add something to a list we just append to it.

Now, there is a really nice way to randomly select from a sequence in Python, so if we have the random module imported, we can come down here and say "I would like to pick one of those random items", so I say random.choice and pick some sequence and it will just give us one random, so that's really nice to write there.

let's hold off on the test here and let's just say "return True", let's just say they are passing for now so we can see the other stuff working.

All right, so like I said, there is going to be a little bit of a problem when we run this, but let's go ahead and save and run this.

Now, how do we run this?

Right-click over here and we can say "run" and pick whatever thing it is we want to run, and run, now, notice, it doesn't really like this stuff being empty here when we call clear, and really we have to just run this outside in the terminal.

So a simple way to do that is just copy what PyCharm is doing.

Here you can see something is happening but we are not really seeing this item, so like I said, we need to flush this because that's a little bit funky, so we are going to say "sys" import that module, go to standard and just say "flush".

Now let's try this again, so yellow, blue, yellow, blue, green, yellow, blue, green, blue- you can see it's just slowly building up as it goes.

All right, we are of course not testing the user, but it looks like this works, except there is one problem, something I don't really like so much here, that green is yellow, that blue is yellow, everything like that, so we can come over here and use an external library, external package that I have installed, and I have installed it with "pip3 install colorama", so we are going to use this thing called colorama, and that lets us add coloring to the console.

I have already installed that like I said, and so the way you use it is you just add in a string colorama.for.red let's say, like so.

We are just going to do this for each one.

Let's just run that again, make sure I hit save, and run it, and now you see, blue is blue, blue is blue, red, red is red, and as it builds up we'll see more of these, yellow is yellow and so on.

Great, so that feels much more like a game to me.

Now it's really down just to testing the player, so what we are going to do is we are going to go through for each thing in our history we are going to ask the user what is the first item, what is the second item, and so on and we'll just see if they can get that right, so let's start out with the little message to them, just to say "look, you are going to need to remember four items", or five items, or whatever it is and let's do this white, so we'll say colorama.fore.white and then what we want to tell them is we want to say "there are three moves, or two moves, or something, we can use this string format style, like so, and we can say .format and say I want to give it the length, the number of items in this object's history.

And then for each one of those things in the history we want to loop over it and test so we'll say "for h in self.history", we want to test something.

Now, I'll show you another good trick here, another good technique, remember, each thing in the history is one of these and what we really care about is the second value, not the first.

Down here, we were just using indexes into it, [0], [1] and so on, but we can do what's called tuple unpacking here, so I could say we can give the text and the entry or the "v" for value, and because this is a length two tuple, the first value is assigned to you and the second is assigned there.

So we can just test against that "v", so let's say something like this, we want to get input from the user, that's super easy, we'll say input, use the input method and we just give the prompt.

And we'll give them a little hint on the things that they can type and then we'll say "if guess != v: return False".

So, the very first time that they get it wrong let's say nope, that was wrong, and in the end if they make it through all of them, they must have gotten them all right, so we'll say "return True".

All right, I think our game is just about ready to play, let's save it and then run it over here and see what we get; green, OK, so it says one move we have to remember, and that was "g", OK, worked, green, green, green, green, now red, so "g", "g", "r", it really seems to like red and green.

Let's just put something wrong so we can see that it said "all right, look, you entered something wrong", it's supposed to be green, you said red, there it goes.

But, we made it to level 7, that was pretty awesome, but what is even more awesome is our game is totally implemented here, so we come in, we create the game, we start out with the empty history, and the various plays that we can make, to show the level, we just loop over the items and we print out the text, and because we are not using an inline, it doesn't flush, so we are going to force the flush here, do rest, to add a move it's super easy, we get a random one from our plays, and to test the player we just go through each one of them, these entries in the history and we unpack the values and we check that their guess is the right value.

There is so many things to learn in Python and it's a very rich and powerful language, but at the same time, you've seen a significant portion of it, in action.

If any of this was too fast, or unclear, please go and review the reference section where we go over every one of these ideas topic by topic, there is something on loops, there is something on conditionals, there is something on methods and so on.

If you need to find out more details about something, before you start the rest of the class, make sure you check out the reference section.

Otherwise, let's move on to getting started with web development.

|

|

|

transcript

|

0:41 |

Before I close out this lightning review on refresher of Python, I want to point out that there is an appendix at the very end covering many concept reviews.

There is about 45 more minutes down here at the end, covering the language concepts point by point, so if you need to understand "if" statements better, there is a short video on that, if you need to work with loops, there is a video on that; define classes, you guessed it, a video on that.

So we are going to move on to building web apps with Pyramid, but if you feel like you need a little bit more, go and jump to the end, check out the language concepts on the part that are little shaky and then come back to chapter 4 and move on.

If you are ready to jump in to web development, you don't have to do anything, you are going to be taken right there when this video finishes.

Let's get started.

|

|

|

|

1:02:47 |

|

|

transcript

|

3:06 |

Over the next couple of videos, we are going to talk about choosing a Python web framework and which one we are going to use for this course.

Let's start by answering the question "what can you build with Python?" Well, it turns out there are a bunch of amazing products and companies that you all use and are familiar with, built with Python.

Let's look at a few of the use cases.

The Onion, the hilarious fake news organization, their web application is built in Python Spotify is also using Python for their web front-end NASA - rockets and spaceships and all sorts of amazing stuff, they are using Python bitly, the short link app, is built with Python.

Bitbucket, Atlassian’s competitor to GitHub is built with Python, that's very nice Survey Monkey, they use Python all over the place Quora, the best general Q&A spot on the internet, they are passionate, passionate users of Python, not only do they use Python for most of their app and their web front-end, you'll see them right frequently looking inside their engineering organization talking about the challenges and how they solve them in Python and so on.

Disqus, one of the most popular comment add-ins for your web site so if you have a blog or say a podcast, and you want to have comments at the end, you can have this nice live pushed-based comment section right at the bottom of your pages and that's largely done with Python, not 100% but much of it.

Instagram uses Python in a lot of places.

Reddit, Reddit is a major user of Python for their website as well as SQLAlchemy for their database YouTube was built with Python Pinterest built their website with Python PayPal is a massive user of Python, you'll see throughout their whole company they are doing many interesting things with Python they are blogging and writing about what they are doing with Python one of their services that does pricings for the exchange rate where they charge you some small percent for a transaction throughout the day that service that answers that question what percent do people have to pay or what should PayPal charge you, throughout the day, that service is written in Python and handles several billion requests per day, and is running down around the millisecond response time.

Dropbox maybe one of the biggest users of Python most of the backend stuff happening at the company at the server-side at Dropbox is happening in Python.

The client stuff side, the little box that does the sinking and the app that runs on your machine, also Python interestingly, so you'll see that Dropbox is a major user of Python and some of the Python core developers, as well as Guido Van Rossum, the creator of Python himself, work there.

So Dropbox is a heavy user of Python and an absolute hotbed of it.

And finally, Talk Python, my websites, my podcast, my training site, all run on Python and we are going to be of course looking inside the code that does that.

If you'd like to see where this information came from, read a little bit more about how each company or product is using Python, you can just check out this bitly URL down here at the bottom, and there is a nice write up featuring these companies as well as more.

|

|

|

transcript

|

2:04 |

When deciding on a Python web framework, it's important to consider the tradeoffs that you make when you choose a particular framework.

So on one hand, we have a host or what are called micro frameworks, these frameworks are very lightweight and they are great for building quick, simple applications, and then you bring many many pieces together to add on functionality.

Will that allow you to make exactly the app that you want because you've only brought in the pieces that you need, it's actually a lot of work and it's a little bit hard for beginners because you don't know about all the little pieces you've got to put together.

On the other hand, we have what I am calling building block frameworks, maybe this is not quite the right term but what I mean is these are the frameworks that have large pieces that you can stack together maybe you want to admin backend for your database, boom here is a little piece you stick in there you want to data access layer right into the framework, boom, there is your ORM, the way that you talk to your database, and so on.

These are great, if that's what you want to use, but if you don't want to use those, if you want to use a different kind of database, say a NoSQL database versus a relational one, then all of the sudden these building blocks can be getting in your way and you have to work your way around them.

That's kind of the way I see the spectrum of the web frameworks, and in the building block area, we have Django.

one of the most popular web frameworks for Python and it has a lot of great building blocks, but like I said, has things like a built in ORM, and if you don't want to access data in the way their ORM works, or you are kind of fighting against the system a little bit, to go and do something different.

On the other end we have frameworks like Bottle, which are fast but very simple and don't come with very much functionality, I would put Flask just up above Bottle in terms of what it brings to the table and how many little pieces you have to put together.

And then in the middle, what I would call the goldielocks range, not to small, not too big, would be Pyramid.

Pyramid is a framework that we are going to be using for this course, it's not as much of a building block thing as Django, you can pick all the various pieces you want to use Mongo DB, no problem, use Mongo DB, it's a little more full featured than some of the micro frameworks.

So, let's take a look at Pyramid now.

|

|

|

transcript

|

2:36 |

Let's have a quick look at the relative performance of Python among all the technologies that you might use to build web applications.

But before I show you this graph, I want to emphasize that performance is not the only thing when you are starting a business, it's much more important that it's easy to work with that it's quick to get something out the door, but it's also nice to know if what you are working with is going to live a while as your business grows that you won't have to replace it right away, that it would be able to handle some decent growth before you maybe have to so some sort of optimization or even change frameworks.

So let's look at Python relative to the other technologies.

Here is a graph of numbers taken from the TechEmpower benchmark, and this is one of the more well respected benchmarks for web applications and it's absolutely comprehensive, there are many frameworks and variations on different servers with different databases and so on.

So here you can see we have a couple of technologies, the fastest one that I put on the list it's not the fastest, but it's definitely interesting, is Bottle.

So Bottle running on Python 2 is quite quick, it's doing over 35 thousand requests per minute.

Than we have Flask, running on Python 2, remember, these are all micro frameworks, they do less so you would expect them to be able to be able to do more of it.

Then we have Pyramid with Python 3 right there and it's coming in third, that's pretty excellent.

Let's look at the rest, just down from that we've got Node.js and MySQL and we have Flask and Bottle in Python 3, we have Django, we have Ruby on Rails and we have ASP.NET running on Mono.

So I think you can see that our choice of Pyramid puts us well to the right of this graph, it's certainly not bad, in terms of performance, but notice something else, that if we look at this on Python 3 alone, remember, Python 2 is getting phased out in just a couple of years, and there will only be Python 3 going forward, if we look at Pyramid 3 on Python 3 and we take away say Bottle and Python 2, we only look at it running on Python 3 for example, well then, our choice looks pretty smart on performance.

So as you can see, Pyramid is a very capable web framework in terms of performance it's been great for all of my businesses, I've been able to run my businesses and websites on Pyramid on simple cheap virtual machines as you'll see we'll do something similar with Digital Ocean, here in this course.

My podcast receives over a million HTTP requests to the Python backend which goes all the way to the database, per month, and running that on a 10 dollar Digital Ocean server doesn't even break a sweat.

Barely registers on the CPU meter.

|

|

|

transcript

|

2:35 |

Let's take just a moment and talk about Pyramid - the web framework and the principles behind it, before we look at the code and the building blocks to create web apps with Pyramid.

You can learn more about Pyramid at trypyramid.com and they have this little saying up here that I think captures a lot about the framework "The start small, finish big, stay finished framework" Idea is you don't have to know a lot to use Pyramid, there is a few simple building blocks and then many more that you can bring in as your app grows in complexity and needs, and they have a 100% unit tests and they are very conservative about pushing on new versions, so it's the "stay finished framework" as well.

Pyramid focuses on simplicity and they take a "pay only for what you eat" approach and it has a really interesting idea behind it that you should be able to get started with Pyramid even if you only have a partial understanding of it, that means you can do the major things, how do I render some HTML to a view, how do I process a post, things like that, without fully digging into all the details which I think is a really constructive way to get started.

Remember, I called Pyramid the Goldielocks framework because it's not a micro framework that has too little, it's also not a large building block framework that you have to take the large building blocks and put them together or not, they focus on the core things that you do in a web framework, mapping URLs and code, templates and serving assets.

Pyramid has great documentation and tutorials to help you dig deeper, we saw earlier that Pyramid is very fast and especially when you consider the Python 3 angle, in the age of cloud computing it's easy to think we can throw as many machines at a problem as we need, that costs money but more importantly that costs complexity, so having a pretty fast framework is a real benefit.

Pyramid has 100% test coverage and their philosophy is if it ain't tested it's broken.

So you can count on new releases of Pyramid not breaking your code.

As you can see, Pyramid is open source, it's available on GitHub and is distributed under a permissive open source license.

Finally, Pyramid is one of the few frameworks that takes a forward-looking approach to Python 3.

Python 3 is the default implementation their documentation and tutorials are in Python 3 and that's the recommended way to run Pyramid.

So as we transition from Python 2 to Python 3 as an industry, Pyramid is already in the right place to make that transition because they have already gone through it.

|

|

|

transcript

|

3:36 |

Are you ready to start writing some code for the web in Python?

Yeah, I definitely am, it's time to get started.

So that's what we are going to do in this section.

So what are the steps to create a project and get started in pyramid?

The first thing that we're going to do actually is not to install pyramid but to install a template manager program that will then install everything or create everything that we need for our pyramid web applications.

So we're going to use this thing called cookiecutter.

Now cookiecutter manages all sorts of project templates and it has hundreds, maybe even thousands of them available.

Many of these are for pyramid, and so we're going to install cookiecutter, external separate package, and then we're going to use cookiecutter to use template or a scaffold to create the starter website.

Now, pyramid web applications have a lot of moving parts, almost all web applications that are realistic have a lot of moving parts, they've got css files, javascript files, images, the actual views probably come along with some testing and things like that, so you might see examples where somebody uses flask or something just create a here is the one function you write to create your app, you can do the same thing in pyramid, but it's not realistic, it doesn't really set up what you need, so this cookiecutter process will put all those pieces together just like you need for pyramid to get going.

Now, one of the things I like to do especially for web applications is create a virtual environment.

Virtual environments in Python allow us to set up a separate copy of the dependencies and a separate set of the dependencies for individual applications, so this means that if I have three web apps, maybe one is using a newer version of pyramid or a new version of sqlalchemy, and the other one is using an older one because we haven't upgraded it yet.

And this means that we can run both of those, side by side on our machine, we don't have to change our global environment and possibly even mess up our system.

So we're going to create a virtual environment, this is technically optional but highly recommended; pyramid web applications are a little bit different in that in their full form they are actually Python packages, so that means we need one additional step, one additional command that we enter to register this in our virtual environment system or whatever Python system we're running in.

So we'll run that and then, we'll serve our web application we'll add some features, and then we'll just go round and around and iteratively develop our app, until it's ready for deployment.

How do we go through these steps?

We can choose one of two options— if you have PyCharm professional PyCharm will let you click a couple of buttons, go through one or two screens, and it will take you through all of these steps.

But even if you're going to use PyCharm, which you don't have to, but if you are going to, it's still nice to see the command line version so you know what the actual steps are, you know the way things fit together.

When you get to PyCharm, you can click the few buttons and be really happy that it put all the pieces together, but really understanding how your web app works is important.

If you have PyCharm community edition, or you're using something else, like Sublime Text or Visual Studio Code or Emacs or some other editor that doesn't have this project template mechanism, you're going to go through the command line edition.

And then of course, you just open it up in that editor.

So for this one, we're going to choose the cli.

Let's jump over to our Mac and create our first project.

|

|

|

transcript

|

6:27 |

All right, it is time to create our project using the command line.

If you're going to use some editor that's not PyCharm professional, this is really the way to do it, if you are going to use PyCharm pro, you can still do it this way, and then just open the folder, and go with it there.

So what we're going to do is we're going to start by installing cookiecutter, and then we're going to actually use cookiecutter to create the project.

So we are going to say pip install cookiecutter -u for upgrade in case you already have it, and --user, so that it just installs for me, it doesn't actually modify the system, and just to be safe, on Mac and Linux you might say pip 3 to ensure that you're installing this into Python 3.

It looks like we've got it installed, there was some kind of update or something but we now have cookiecutter, so if we go over here to the pylons organization which has pyramid as a subset of it, you can see there is a number of cookiecutter templates if you browse around; the one we're going to use is this pyramid cookiecutter starter, this is the certain most basic, most foundational version, it doesn't pull in a whole bunch of different things like other specific database integrations and so on, because we're going to do that manually and exactly the way we want to do it.

So we're going to run this template, and all we need to do that is get this url to the github page, you know it's a cookiecutter template because you have cookiecutter.json.

Now cookiecutter can install all sorts of things not just this, it can create templates and generate them for all sorts of things but it's going to work really well for this.

So we're going to come over here and make sure we're in desktop this project area thing, and notice it's empty right now so we're going to say cookiecutter and give it this, I've already downloaded this one, so it's going to say can we get a new copy, yes is a good answer, but this is typically how you'll see it here, it will ask you a question and say what do you want to call the project let's just call it my web app, and then it's going to propose a repo name, and a repo name is maybe not the best nomenclature here, really this is the actual folder structure for the Python pyramid project and this is going to be the Python package name that it's going to use, so you have to avoid certain things like test, anything that's basically a built in package in Python right, like os wouldn't be good, other things you might use, requests wouldn't be good, so just be aware of it when you pick this.

And then, we're going to pick Chameleon for this course the JInja 2 probably is the most popular which is why it's a default but Chameleon is a much cleaner syntax in my opinion, much better language for the web, so we're going with that.

there's a bunch of stuff, it says okay we've created the project now if we look here, you can see there's folder that contains stuff that has to do with packaging, so the changes, the setup.py and so on, and then here we have our actual web projects we've got our static files, our templates, our tests, our views and so on, so it gives us a little idea of what we could do, we could come over here and we could cd into our folder that is created the my web app, and then it proposed we make a virtual environment so let's go do those things.

So we'll cd in here, and then we're going to make a virtual environment slightly differently than they propose, but we're going to say Python 3-m for module, so run the venv module, we're going to add a --copies, the reason is on Mac, I don't believe this is a problem on the Windows or in Linux but on Mac, the way PyCharm interacts with the virtual environments if you don't do the copies, it doesn't resolve the symbolic links correctly so you want a --copies and we'll call it .env.

They proposed just env, but if you used .env, PyCharm will automatically detect and use this so it will save you one step along the way.